How much cover do I really need?

Article29 September 2023

What's the right amount of cover...

Because everyone’s needs are different, this is a great question is best answered with the support of a financial adviser. They will work with you to determine the level of cover you require for your personal circumstances– not too little, not too much.

This personalised and in-depth needs assessment may be based on your personal circumstances such as your total debt position, assets including superannuation, property, as well as your family circumstances including education and childcare needs.

There are three important things to consider:

- How much would you require to pay off any existing debts or any large expenses in one go?

- What would be the cost of living for yourself and your loved ones during a recovery from an incident that changes your lives permanently, or even temporarily, to the extent where you can’t work?

- How much would you need for the financial security of your dependents and the life you wish for them – including the cost of their education and continued living expenses?

Think about what you're protecting

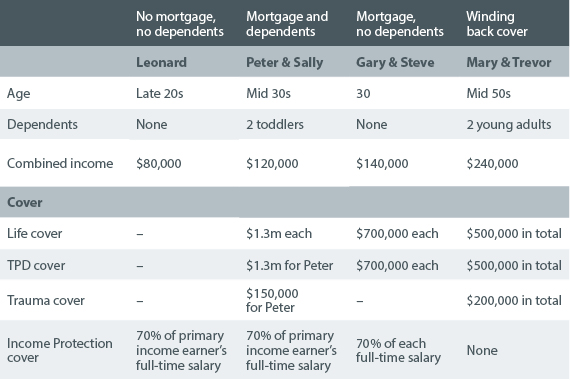

Leonard is 27 years old and single.

He rents a 2-bedroom apartment, which he also uses as a home office where he works as a freelance graphic designer, earning $80,000 a year.

Aside from a credit card and a car loan of $35,000, Leonard has no major debts, or financial dependents. Leonard decided to see a financial adviser for help in putting a plan together to save for a deposit to buy a home.

Snapshot of his cover:

- In addition to a savings and passive investment plan, Leonard’s adviser recommended Income Protection cover of $4667 per month, representing 70% of his monthly salary. This is because Leonard is heavily reliant on his income to sustain his lifestyle and cannot rely on things like sick leave due to being self-employed. He does, however, have default TPD cover in his industry super fund, to cover a major absence from work due to permanent disability.

- Without any substantial savings to draw on, and not wanting to compromise his savings plan, Leonard opts for a shorter waiting period to start receiving benefits (30 days).

- Additionally, to save money on his premium, Leonard opts for a shorter benefit period (2 years), rationalising that his relatively safe occupation means any injury is unlikely to be severe enough to keep him out of work for a stretch.

Leonard now has affordable certainty that his biggest financial asset in life – his income – is secured should anything happen to prevent him from working and earning a living.

Note: This case study is hypothetical and is not meant to illustrate the circumstances of any particular individual.

Peter and Sally are married with their two children under five years old.

They are proud homeowners. Peter works in construction, while Sally works part-time as a nurse and is primary carer for the two kids.

With a mortgage and total debts of $600,000, and living expenses for a family of four, with the support of a financial adviser, they made an informed choice to take out life insurance soon after they purchased their home.

Their primary motivation was to protect the financial future of their children.

Snapshot of their cover:

Peter and Sally both took out life cover totalling $1.3 million to secure their kids’ financial future should something happen to one or both of them – enough to pay off immediate debts, cover for the loss of 6 years of future income in which the kids are still dependent, as well as pay for the education Peter and Sally wish for them.

In addition to this, because Peter is the primary income earner, he also took out:

- $1.3 million of TPD cover given the high risk nature of his work.

- income protection of $5,000 per month, representing 70% of his monthly salary package

- $150,000 of trauma cover to replace around 2 years of income should he need time to recover from an illness or injury.

Sally also took out $150,000 of trauma cover to allow Peter to take unpaid leave in case she suffers serious illness or injury, and to cover out-of-pocket medical expenses.

Peter and Sally now have the peace of mind knowing that if something happened to both or either of them, their loved ones could live the life they wish for them.

Note: This case study is hypothetical and is not meant to illustrate the circumstances of any particular individual.

Gary and Steve are in their early 30s, newly married and recently bought their first home together.

They have a mortgage and personal loans totalling $500,000.

Focusing on their careers, socialising with friends and family and overseas travel are important to them right now.

Following a referral from a colleague, Gary and Steve sat down with a financial adviser to discuss life insurance. With the support of their adviser, they made an active choice to takeout life insurance while they’re in their 30s.

Their primary motivation was to protect each other and their primary assets – their home, and their incomes – in the event of something happening to either one of them.

Snapshot of their cover:

- Gary and Steve both took out life and TPD cover of $700,000 each to pay off their mortgage and other small debts, and have around 2 years of lost future income to support their partner through difficult changes.

- They both also took out income protection at 75% of their salaries to ensure they are able to continue to finance their mortgage, and other living expenses, in the event that illness or injury caused a break in work.

Gary and Steve now have security and peace of mind knowing that if something happened to one of them, the financial security of the other would be secure.

Note: This case study is hypothetical and is not meant to illustrate the circumstances of any particular individual.

Mary and Trevor are in their mid-50s. They both work full-time. Mary is a high-school teacher and Trevor is an accountant at a large firm.

Their two daughters are at university, and Mary and Trevor expect to pay off their mortgage within 3 years – enabling them to be debt free for the first time in decades.

They both took out life insurance 20 years ago when they bought their home and their oldest daughter was 6 months old. At the time, their intention was to secure the financial future of their growing family.

Snapshot of their cover:

- Mary and Trevor both have life cover totalling $1.4 million, and the same amount of TPD cover.

- They had decided on that amount of cover many years ago with their adviser to ensure they had enough protection to pay off their mortgage, be debt free and set aside funds for their daughters’ private school education.

- They also have $200,000 of trauma insurance to cover lost income should one of them fall ill, to cover the cost of out-of-pocket medical expenses and financially support their lifestyle during the time they are out of the workforce to concentrate on recovery.

- Their cover was taken on a stepped premium basis (where premiums are based on age at every policy anniversary).

- Naturally, as a result of getting older, their life insurance premiums have been steadily increasing. Their age, and the size of the increases, prompted them to sit down with their adviser to review their cover.

- Based on a thorough assessment of their current and future protection needs – considering that they have paid down their debts, and their daughters are closer to being financially independent - they were able to reduce their life and TPD covers to $500,000. This has significantly reduced their premiums.

Mary and Trevor also now have a plan to cancel their life and TPD covers in 5 years – when their assets and investments are sufficient to no longer need that protection.

Note: This case study is hypothetical and is not meant to illustrate the circumstances of any particular individual.