Our commitment

At OnePath, we have spent a lot of time trying to better understand the needs of life insurance customers across Australia, irrespective of who they are insured with.

We’ve learnt that it’s absolutely clear that the industry needs to improve the level of service provided to customers.

You told us that:

- Trust is critical, and it isn’t where it needs to be.

- The complexity of life insurance can be intimidating and to get the most out of your cover, you need help to understand how your policy works.

- You barely hear from your life insurer, whoever they are – and that needs to change.

- You need to hear more from us about the things that you find important, so you can take control of your insurance.

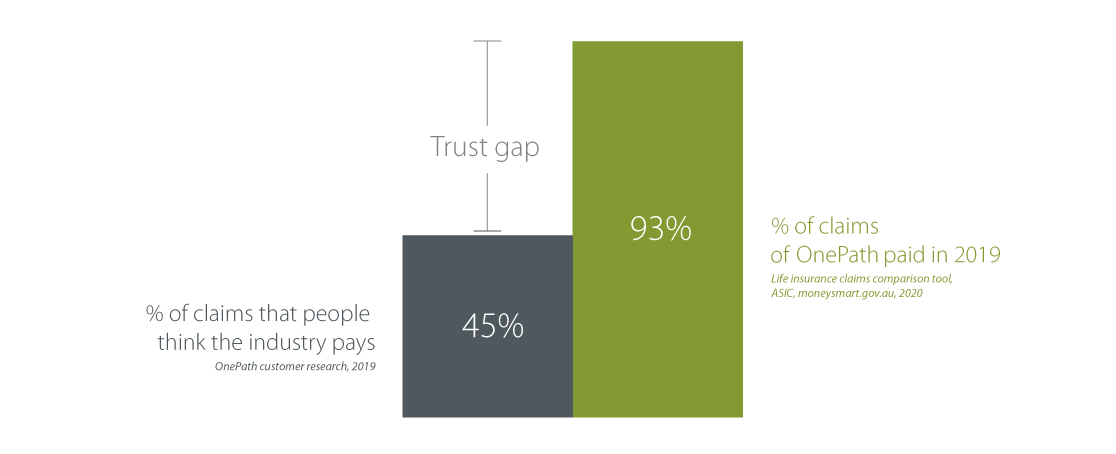

Most importantly, we need to eliminate your uncertainty, and deliver real value, by demonstrating that claims will, and do, get paid. In 2023 OnePath paid more than 9 out of every 10 of claims lodged by advised clients [i], however we were surprised to find that many of you think that all life insurers only pay about 45% of claims.

We call this issue the ‘trust gap’, and we’ve listened. We’re absolutely committed to changing for the better and eliminating that gap.

What action you can expect from us

Talk is cheap, so we need to meet the service standards you expect from us. We’re committed to doing that by giving you the clarity, certainty and control you expect from your insurer. You will see this commitment come to life in three key ways:

#1 We’re determined to make insurance understandable

We’ve invested heavily to develop a simple and easy to understand educational website OnePath Clarity, because we have a fundamental duty to make sure you understand what you’ve bought.

#2 We’re putting you in control

We’ve built an online self-service portal called My OnePath Life to allow you to make certain changes to your policy at any time - giving you a level of visibility and control over your cover that you’ve never had before.You’ll be able to, amongst other things:

- View your policy and important documents

- Change your beneficiaries, and update your contact details and preferences

- Update your payment details

- You can start earning Qantas Points on premiums paid for eligible OnePath insurance policies - terms and conditions apply [ii]

- Access LiveWell, your home for health, wellbeing and rewards [iii]

My OnePath Life is available now for eligible customers [iv] and we’re rolling out in stages.

#3 We’re giving you more value — beyond insurance cover

We want more people to live well and enjoy happier, healthier lives.

OnePath introduces ‘LiveWell by Zurich’, our global health and wellbeing app designed to help you make health a habit. With goal setting, daily meditations, activity tracking and health check-ins, LiveWell is so much more than a wellness app. Plus you can earn Health Points to access discounts on everyday living expenses.

If you want to learn more, read our FAQs.

Our ongoing commitment to you

On behalf of OnePath, please know that we’re committed to you by making sure you have everything you need to feel secure and valued. We look forward to improving our service to you, and continuing to protect you and the people you love.

Sincerely,

Brendan Norton

Head of Customer and Adviser Experience Life & Investments

[ii] You must be a Qantas Frequent Flyer member and correctly register your Qantas Frequent Flyer membership details with OnePath to earn Qantas Points on eligible insurance policies. Eligible insurance policies are the policies listed in the ‘OnePath and Qantas Frequent Flyer Rewards terms and conditions’ available at onepath.com.au/qff-terms-conditions, as defined for ‘Eligible OnePath Insurance Policy’. A joining fee usually applies. However, OnePath has arranged for this to be waived for new customers who join at qantas.com/onepathjoin. This complimentary join offer may be withdrawn at any time. Membership and points are subject to Qantas Frequent Flyer program terms and conditions available at qantas.com/terms. The maximum number of points you can earn on eligible policies is capped at 20,000 points per year, per policy. Qantas Points accrue in accordance with and subject to the ‘OnePath and Qantas Frequent Flyer Rewards terms and conditions’. Qantas does not endorse, is not responsible for and does not provide any advice, opinion or recommendation about these products or the information provided by OnePath in this communication.

[iii] Zurich Australia Limited trading as OnePath Life (OnePath) ABN 92 000 010 195, AFSL 232510 makes the LiveWell by Zurich application available to you under an arrangement with Zurich LiveWell Services and Solutions Ltd. Zurich Australia Limited is a company within the Zurich Financial Services Australia Group, which is a subsidiary of Zurich Insurance Group Ltd (ZIG).

Zurich LiveWell Services and Solutions Ltd, a company incorporated in Switzerland and part of ZIG, is responsible for and operates the LiveWell by Zurich application.

[iv] To be eligible for My OnePath Life you need to be an individual policy holder of a OneCare Non-Super policy.